Bank of America Mobile Banking

Review Bank of America Mobile Banking

The Bank of America Mobile Banking application has revolutionized the way customers manage their finances on the go. Launched to provide seamless mobile banking services, it allows users to access their bank accounts from anywhere at any time. With an intuitive design and robust functionalities, this app is tailored to meet the needs of modern banking customers.

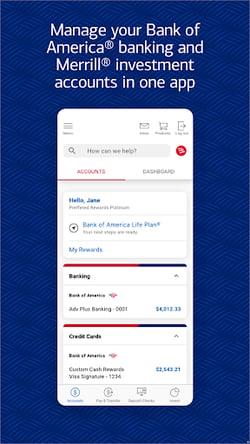

Some of the key features of the Bank of America Mobile Banking app include:

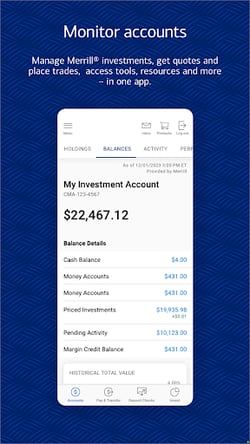

- Account balance checks and transaction history

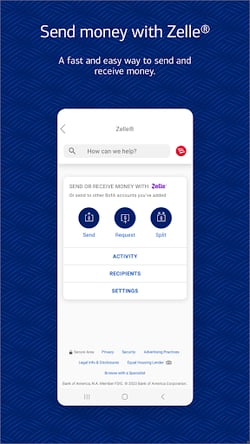

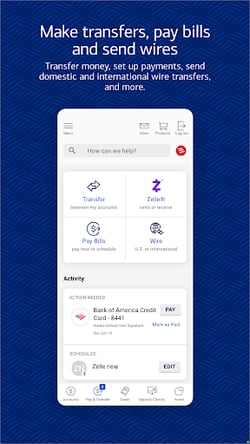

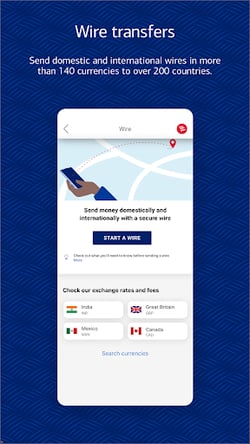

- Easy funds transfer between accounts

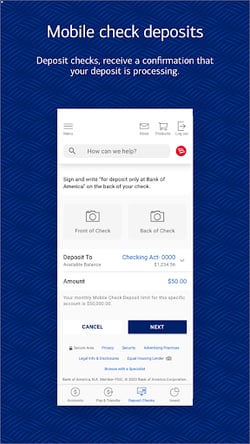

- Mobile check deposit for added convenience

- Pay bills directly through the app

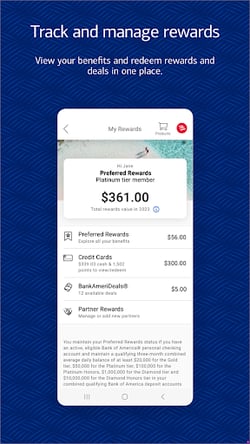

- Access to budgeting tools to track spending

Developed by one of the largest banking institutions in the United States, Bank of America, this app reflects the company's commitment to innovation and customer service. The bank aims to provide users with a reliable and user-friendly platform that enhances their banking experience. Since its inception, the app has grown in popularity, catering to millions of users nationwide.

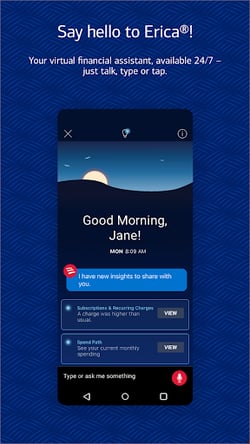

The design and interface of the Bank of America Mobile Banking app focus on usability and accessibility. The clean layout ensures that all essential banking functions are just a few taps away. Users appreciate the straightforward navigation, which makes managing their finances effortless. The app also adapts well to various screen sizes, ensuring a consistent experience whether on a smartphone or tablet.

In terms of performance, the Bank of America Mobile Banking app stands out due to its speed and reliability. Transactions are processed quickly, making it easy to access funds when needed. Ongoing updates and improvements keep the app running smoothly, minimizing crashes and enhancing user satisfaction. Customers can trust that their financial information is secured with advanced encryption technologies, making this app a safe choice for banking.

As reported on appsretreat.com, the Bank of America Mobile Banking app truly transforms how users interact with their finances, combining essential banking features with top-notch security and design.