Intuit Credit Karma

Review Intuit Credit Karma

Intuit Credit Karma is a revolutionary mobile application designed to empower users with comprehensive financial insights. Launched in 2007, it was developed with the goal of providing users access to their credit scores and reports, as well as personalized financial recommendations. Over the years, it has evolved into a multifaceted platform that helps millions of users manage their finances effectively.

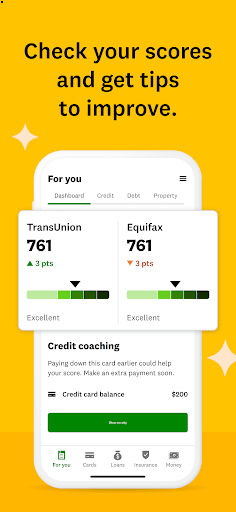

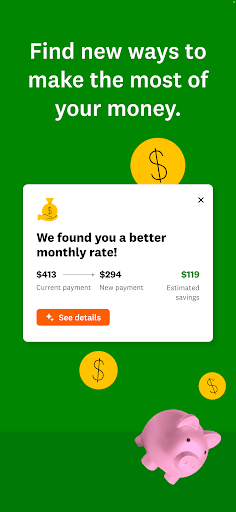

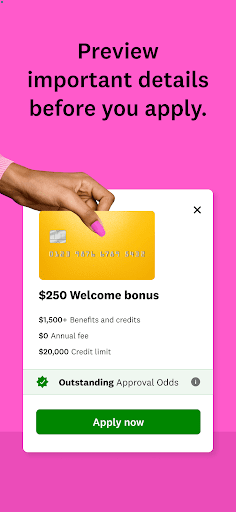

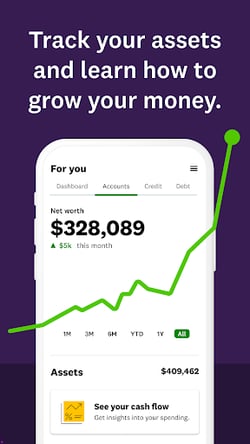

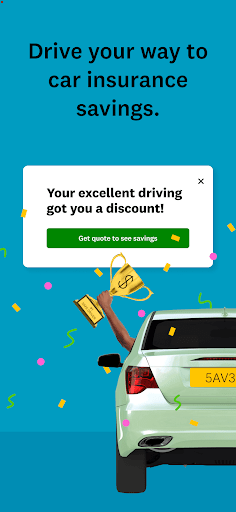

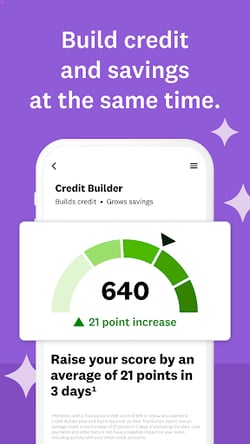

This mobile application boasts a variety of features that cater to diverse financial needs. Users can access their credit scores for free, receive alerts on any significant changes, and explore tailored credit card offers and loans based on their credit profile. Furthermore, the app includes tools for budgeting and monitoring spending habits, which contribute to enhanced financial literacy and management.

One of the major advantages of the Intuit Credit Karma app is its user-friendly interface. Designed with the average user in mind, it offers smooth navigation and visually appealing dashboards that illustrate credit health in a comprehensible manner. The app also leverages advanced algorithms to provide personalized recommendations, ensuring that each user receives the most relevant financial advice tailored to their unique circumstances.

Developed by Intuit Inc., a leader in financial software solutions, Intuit Credit Karma exemplifies the company's commitment to helping individuals achieve their financial goals. Intuit has cultivated a strong reputation for innovation in the financial technology sector, and Credit Karma represents a successful expansion of their services into the personal finance domain.

In terms of performance, the Intuit Credit Karma app has received positive feedback for its reliability and speed. Users report quick access to their credit information, with minimal loading times, which enhances the overall user experience. The app also consistently ranks highly in app stores, a testament to its functionality and popularity among those seeking to improve their financial literacy.